Table of Content

ORNL is encouraged to provide us with this information. When we receive this information from the credit union, we will provide it here. The Federal Reserve has started to taper their bond buying program. Our home refinance calculator shows how much you can save locking in lower rates. Homeowners who had up to $1 million in mortgage debt before the new tax law was passed will still retain the old limit even if they refinance their homes.

At ORNL FCU, we offer mortgage loans designed to fit your specific needs, with your best interest in mind. Make payments at your local branch, Interactive Teller Machine , or online 24/7. We offer many loan types to help you with your financial needs. To pay a loan with one of your ORNL FCU accounts, simply log in to Online Banking. We can refinance your original mortgage, a HELOC, or an old home equity loan. Ornl requires a down payment of between 10-and 20% of the cost of your vehicle, depending on the type of vehicle you are purchasing.

Comparing home equity loans and home equity lines of credit

Don’t deal with a lender who wants you to get financing with monthly payments bigger than you can comfortably make. ORNL FCU is a member-owned, not-for-profit credit union. That means profits are paid back to you with higher savings rates and lower loan rates. Set yourself up for success with a personal loan that’s designed to help you thrive. ORNL FCU offers a range of personal loans with great rates and terms — so that you can achieve more without financial fear.

As long as you owe money on your house, you’re at risk of losing the roof over your head—and that’s never good. That’s why we teach people to put at least 10–20% down when buying a home and then pay that sucker off as fast as possible! The borrower is slave to the lender, so you want to get out of debt quick. HELOCs are dangerous, because it’s easy to get stuck in that revolving credit line whenever an emergency or new expense pops up. So, your rate can go up pretty much whenever the lender wants. It’s just new debt that’s been packaged to sound better than the old stuff.

How much home equity loan can I get?

He previously worked as a mortgage broker and was involved in wholesale operations at JP Morgan Chase. He has been a mortgage loan originator at ORNL FCU since 2008. Roy has a Bachelor of Arts from the University of Tennessee, Knoxville in Economics and has worked with both Hamblen and Sevier Counties’ Chamber of Commerce. The lowest APRs are available to borrowers requesting at least $80,000 for second liens or $200,001 for first liens, with the best credit and other factors. Keep your existing mortgage and get the cash you need. 94.78% Ornl Federal Credit Union has an average approval rate.

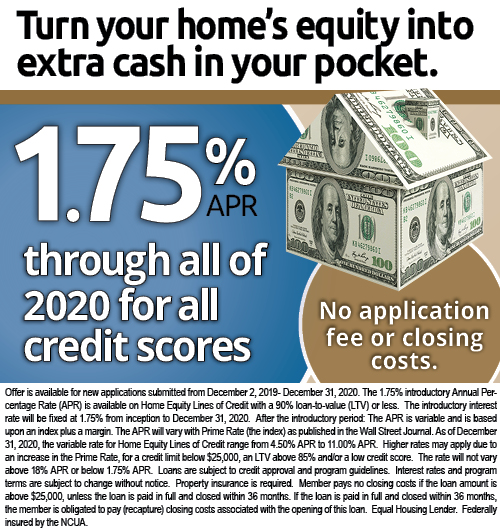

Even though home equity loans have lower interest rates, your term on the new loan could be longer than that of your existing debts. Refinancing your home, getting a second mortgage, taking out a home equity loan, or getting a HELOC are common ways people use a home as collateral for home equity financing. But if you can’t repay the financing, you could lose your home and any equity you’ve built up. Your equity is the difference between what you owe on your mortgage and how much money you could get for your home if you sold it. High interest rates, financing fees, and other closing costs and credit costs can also make it very expensive to borrow money, even if you use your home as collateral. Ornl also offers longer-term loans, which can help you secure a lower interest rate.

Why Bank With ORNL Federal Credit Union?

And be sure to avoid any lender who promises one deal when you apply, but gives you a different set of terms to sign, with no good explanation of the change. Agents are happy to assist with payments from your ORNL FCU account at no charge. Use a fixed-rate and fixed-term loan to your advantage. Our team is here to help you find the personal loan that’s right for you — you’re not in this alone. Hassle-free payments can be made online or at a community branch or Interactive Teller Machine . The Annual Percentage Yields provided do not take into consideration any fees that you may incur.

Know that legitimate lenders will give you time to review the terms of the offer in writing and want you to understand them. They will never ask you to sign blank documents or hide disclosures and key terms. You use your home as collateral when you borrow money and “secure” the financing with the value of your home.

Stress-free applications with fast processing help you quickly get financing. Let ORNL FCU be your full-service financial institution. Fraudsters are currently sending text messages to some members instructing them to click a link to regain access to their account.

You’re guaranteed a certain amount, which you receive in full at closing. If instead you have ahigher-priced mortgagewith an APR higher than a benchmark rate called the average prime offer rate , you may have additional rights. You may be entitled to these rights if your higher-priced mortgage is used to buy a home, for a home equity loan, second mortgage, or a refinance secured by your principal residence. If you have a higher-priced mortgage, theCFPB has additional information about your rights.

The Three-Day Cancellation Rule applies to many home equity loans . Before you sign, read the loan closing papers carefully.If the loan isn’t what you expected or wanted, don’t sign. You also generally have the right to cancel a home equity loan on your principal residence for any reason — and without penalty — within three days after signing the loan papers. For more information, see The Three-Day Cancellation Rule.

Each time you refinance, you pay additional fees and interest points. You’ve opened all your gifts, and now it’s time to open those post-holiday credit card statements. If you were a little too jolly with your holiday spending, here are some tips to help you pay down your credit card debt. When you use your credit card to buy something, you... Karen is an NMLS licensed mortgage loan originator and has been with ORNL FCU since 2015.

No comments:

Post a Comment