Table of Content

Shopping around for quotes from multiple lenders is one of Bankrate’s most crucial pieces of advice for every mortgage applicant. When you shop, it’s important to think about not just the interest rate you’re being quoted, but also all the other terms of the loan. Keep in mind that some institutions may have lower closing costs than others, or your current bank may extend you a special offer. There’s always some variability between lenders on both rates and terms, so make sure you understand the full picture of each offer, and think about what will suit your situation best. Comparison-shopping on Bankrate is especially smart, because our relationships with lenders can help you get special low rates. Estimated monthly payment and APR calculation are based on down payment of 20% and borrower-paid finance charges of 0.862% of the base loan amount.

There are a complex set of factors that impact mortgage interest rates, including broader economic conditions, the monetary actions of the Federal Reserve and inflation. The average mortgage rate for a 30-year fixed is 6.60%, more than double its 3.22% level at the start of the year. Before you start shopping around for a lender, you can find out how much you could save by using a mortgage refinancing calculator. This information helps underwriters estimate how much of a loan you can afford and the costs of the loan. If you don’t lock in right away, a mortgage lender might give you a period of time—such as 30 days—to request a lock, or you might be able to wait until just before closing on the home. Another important consideration in this market is determining how long you plan to stay in the home.

Pay attention to LTV

For conventional mortgages, a credit score between 620 and 720 is preferred. The credit score minimum might also depend on your cash reserves, DTI and the loan-to-value ratio. Also, lenders usually reward high credit scores with the lowest available interest rates.

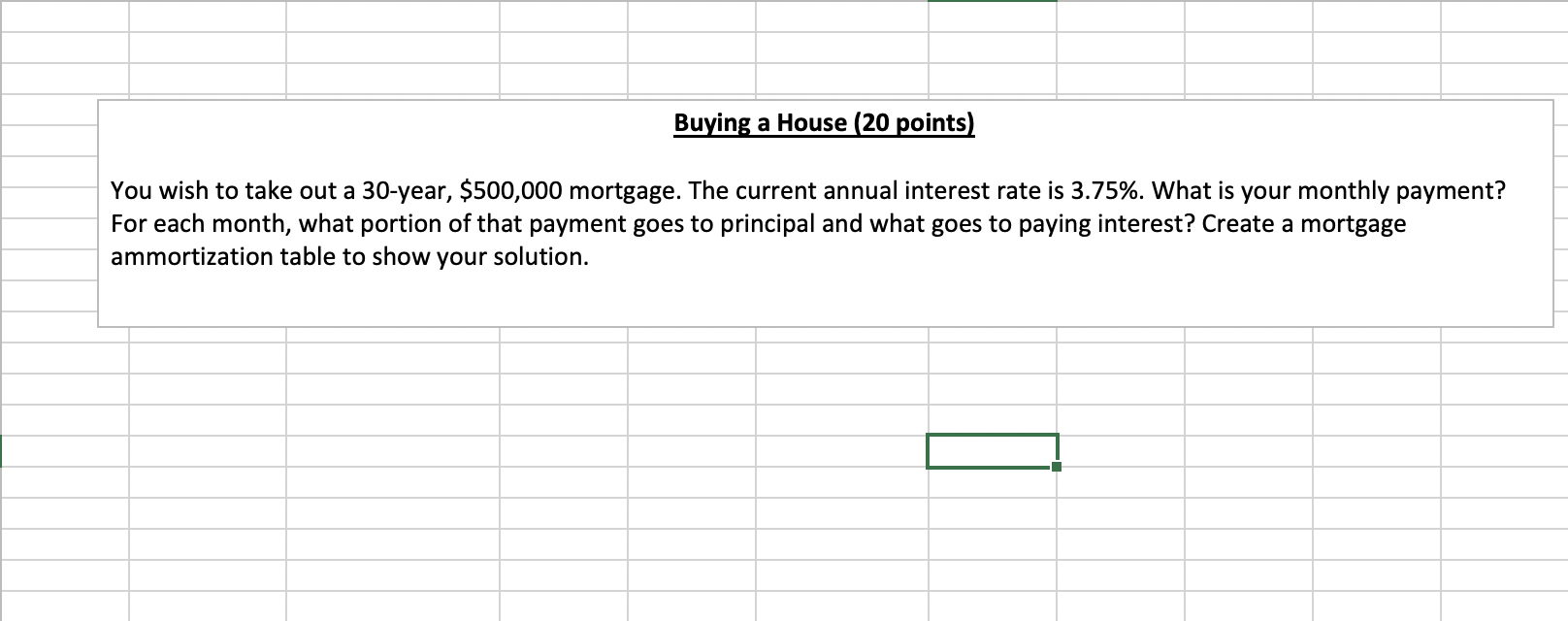

A cash-out refinance is considered more risky and will usually have a higher interest rate. The amount of equity you have in your home also matters, more equity tends to lead to lower rate. Your mortgage’s amortization schedule will show exactly how much of each monthly payment is paying off the loan principal and how much goes to paying interest.

Mortgage interest rates vs. APR

You’re also likely to look better to lenders if you don’t have too much debt relative to your income. You should keep a regular watch on mortgage rates, which fluctuate often. Also see if you can manage a mortgage payment for a shorter loan term since they usually have lower interest rates. A better credit score will help you secure a better rate and make your refinance even more cost-effective. If you're not happy with your credit score or the rates you're being quoted, work on boosting your credit first, then try to refinance again once you've improved it. Typically, mortgage lenders want to see a credit score of 620 or better for a refinance, but there are some refinance options if you have poor credit, including streamline programs.

If you have smaller expenses that will be spread out over several years, such as ongoing home renovation projects or college tuition payments, a HELOC might be a better option. Your potential home equity loan rate depends in part on where your home is located. As of Dec. 15, 2022, the current average home equity loan interest rate in the five of the largest U.S. markets is 7.77 percent. When shopping for a home equity loan, look for a competitive interest rate, repayment terms that meet your needs and minimal fees. At Bankrate, our mission is to empower you to make smarter financial decisions. We’ve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation.

Bank of America

For home equity products, some lenders also reserve their best rates for borrowers willing to set up automatic payments or withdrawals. With rates increasing, it’s important to compare today's mortgage rates before committing to a loan. The best mortgage rate for you will depend on your financial situation. When comparing offers, make sure you look at the difference between the interest rate and the annual percentage rate . The interest rate is what you’ll pay on the principal loan, while the APR includes the interest rate, other mortgage fees, and some closing costs. When looking at APRs, ask the lender what fees are included in the APR calculation so you can be sure you’re making an apples-to-apples comparison.

In addition to the qualification process, refinancing costs can be substantial, totaling up to 6% of the original loan’s outstanding principal. So it’s important to consider whether a refi is the right move for you. A cash-out refinance gives homeowners the opportunity to access the equity in their home, with the option to also lower their interest rate.

Mortgage interest rate vs. APR

For those wanting to consolidate high-interest debt or make much needed home repairs or upgrades, a HELOC could make sense. If you go that route, you’ll want to understand the repayment schedule, interest rate and fees because they could differ from a traditional mortgage. Check out the refinance rates charts below to find 30-year and 15-year refinance rates for each of the different mortgage loans U.S. If you decide not to purchase mortgage discount points at closing, your interest rate may be higher than the rates shown here. To learn more about rates and to see what you may qualify for, contact a mortgage loan officer.

A refinance allows you to pay off your old loan and replace it with a new mortgage at a new term and a new rate. This can lower your monthly payments and potentially allow you to pay off your mortgage faster. The refinance process is similar to the process of applying for a mortgage to buy a home. You’ll need to meet the lender’s criteria around credit score and debt, as well have your home appraised.

You’ll also need to pay closing costs, although these are typically significantly less than they are for a purchase loan. To find the best refinance rates, you could start with our list of best mortgage refinance lenders. Just keep in mind that some of the rates you see online might not apply in every situation—say for a credit score that’s much lower or much higher than average. You can also try to negotiate an optimal rate with your current lender by shopping around and presenting some good offers from other lenders on both loan rates and terms. A good rate on any type of loan is generally considered to be a rate lower than the national average. The rates that lenders display on their websites are typically the best rate they offer,often reserved for borrowers with higher credit scores and a lower loan-to-value ratio.

The Federal Reserve just hiked interest rates, and mortgage rates could change quickly. If you’re looking for a cash-out refinance, you should also consider home equity loans. If you’re eligible for a USDA or VA loan, you won’t need to put any money down. Mortgage lenders come in all shapes and sizes, from online companies to brick-and-mortar banks — and some are a mix of both. Decide what type of service and access you want from a lender and balance that with how competitive their rates are. You might decide that getting the lowest rate is the most important factor for you, while others might go with a slightly higher rate because they can apply in person, for example.

For a cash-out refinance, most lenders require you to have a minimum of 20 percent equity in your home. For Bankrate’s overnight averages, APRs and rates are based on no existing relationship or automatic payments. One of the most important factors in refinancing is figuring out your break-even timeline. A refi usually comes with upfront costs at the closing, just like an initial mortgage, and those can be thousands of dollars or more. If you're not planning to stay in your current home for more than a few years, the savings you get from a lower rate might not outweigh those costs before you move. Bankrate's refinance breakeven calculator can help you figure out this timeline.

No comments:

Post a Comment